Is there last date to register GST in India?

Is there last date to register GST in India?

When is GST registration time getting expired?

Will GST authorities re-opens GST registration date?

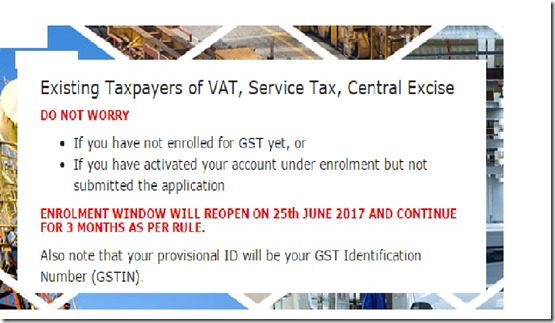

Not yet registered with GST? No worry ! GST registration re-opens on 25th June, 2017.

Did deadline fix for time of registration of GST? Can I register for GST

now? When is the final date for GST enrolment in India?

Update on 17th June, 2017:

According to GST portal:

1. If you are a Taxpayer having received Acknowledgement Reference Number (ARN):

You should be able to download the Provisional Registration Certificate from "Download Certificates" at GST website from 27th June 2017.

2. If you are a Taxpayer, who has saved the enrolment form with all details but has not submitted the same with DSC, E-Sign or EVC:

You will receive the ARN at your registered email ID, if the data given are successfully validated after 27th June 2017.

In case of validation failure (data like PAN not matching), you should be able to login at the same portal from 27th June 2017 onwards and correct the errors. You can refer

the registered email for details of the errors.

3. If you are a Taxpayer, who has partially completed the enrolment form:

You can login at the portal on the above mentioned date and complete the rest of the form.

4. If you are not an existing Taxpayer and wish to register newly under GST

You would be able to apply for new registration at the GST portal from 25th June 2017.

Click here: Existing VAT payers in India can enrol for GST registration now

The registration of GST in India (Migration procedures) from existing VAT,Service Tax, Central Excise to GST online digital has been opened. (Click here to get details of enrolment of GST registraion for existing tax payers in India). The last date to register GST online by exisiting Tax payers in India has been mentioned above. However, the final date to close GST registration can not be determined by GST authorities as GST Law has not been come in to force when posting this article. So the last date for migration of GST in India might be extended further. GST registration last date for existing Tax payers might be extended by GST authorities. The existing tax payers fall under GST may contact the concerned authorities to find last date to register with GST to migrate present data to new data with required additional documents if any. The last date mentioned for migration of GST registration mentioned might be to minimize server traffic of GST common web portal for registration. However, you may reconfirm with concerned authorities to find last date to enrol GST registration for existing tax payers.

GST registration time limit for a person liable to register in India

We are liable to obtain GST registration in India. What is the period of time allowed by government to take GST registration in India? When is the last date to register for GST in India, if we are liable to pay?

We are liable to obtain GST registration in India. What is the period of time allowed by government to take GST registration in India? When is the last date to register for GST in India, if we are liable to pay?

According to GST Law:

Any person should take a Registration, within thirty days from the date on which he becomes liable to registration, in such manner and subject to such conditions as may be prescribed.

So, once a person is liable to register with GST as per GST Act, he has to obtain GST registration within 30 days from which he is liable for GST registration.

This post explains about the time of GST registration required in India, once a tax payer becomes liable to pay GST in India. You may share your views below about GST registration time limit for a person liable to pay GST tax in India.

Click here to know GST rate on Goods and Services

GST Exemption list of goods and services

Find HSN number or Service tariff code for GST

GST registration guidelines

Indian GST Laws

How to export your goods?

Registration procedures and formalities to obtain GSTIN

How many digits in GSTIN under Goods and Service Tax registration

Would multiple registration be allowed under Goods and Service Tax (GSTIN)?

Procedure for obtaining Registration number of GSTIN

Procedures to get GST Registration number for IT exempted proprietorship firms.

Process of application for registration under GST Act to obtain GSTIN

Different application Forms for registration under Goods and Service Tax Act (GSTIN)

Application for registration under GST Act to obtain GSTIN

GST registration and returns filing procedures for PSUs and Government entities

How is time of supply accounted under GST Tax Calculation

Valuation of GST under special cases

Valuation of GST Taxable supply

When to pay GST for supply of services?

When to pay GST?

GST on short supplied goods and services by nature

Goods and services exempted to pay GST

Who has to pay GST?

GST Composition Levy

How to cover the risk of Cargo loss or damage

How to customs clear Cargo arrived in a port where in import license obtained for another port

How to differentiate BL and HBL?

How to differentiate CPT and DAP in shipping terms

How to divert cargo from one port to another?

How to file bill of entry Manually. What is manual filing of Import Documents?

How to file Bill of Entry on line? What is called Noting in bill of entry

How to get exemption of Sales Tax under exports.

What happens if overseas buyer not paid export bills discounted.

What happens if proper tracking of goods not effected in export import business?

What happens if your buyer rejects cargo? What are the major problems if consignee not taken delivery of cargo?

How to get export order from foreign buyers?

How to get RCMC from Export Promotion Councils

How to hide invoice value of original contract under high sea sale transactions

How to know the quality, quantity or contents of goods before import customs clearance

How to know volume of LCL cargo if not measured at factory

Transferability of Bill of Lading

Transhipment - A redefinition

Travelers to India under import duty exemption, Frequently Asked Questions Part 2

Triangular export

Did deadline fix for time of registration of GST? Can I register for GST now? When is the final date for GST enrolment in India? Is there last date to register GST in India? When is GST registration getting expired? Will GST authorities re-opens GST registration?